We are India's fastest growing online business services platform dedicated to helping people to start and grow their business, at an affordable cost. Our aim is to help the entrepreneur with regulatory requirements, and offering support at every stage to ensure the business remains compliant and continually growing. We are Private Organization and providing services and assistance for Business Benefits who require consultation on IEC.

Application For

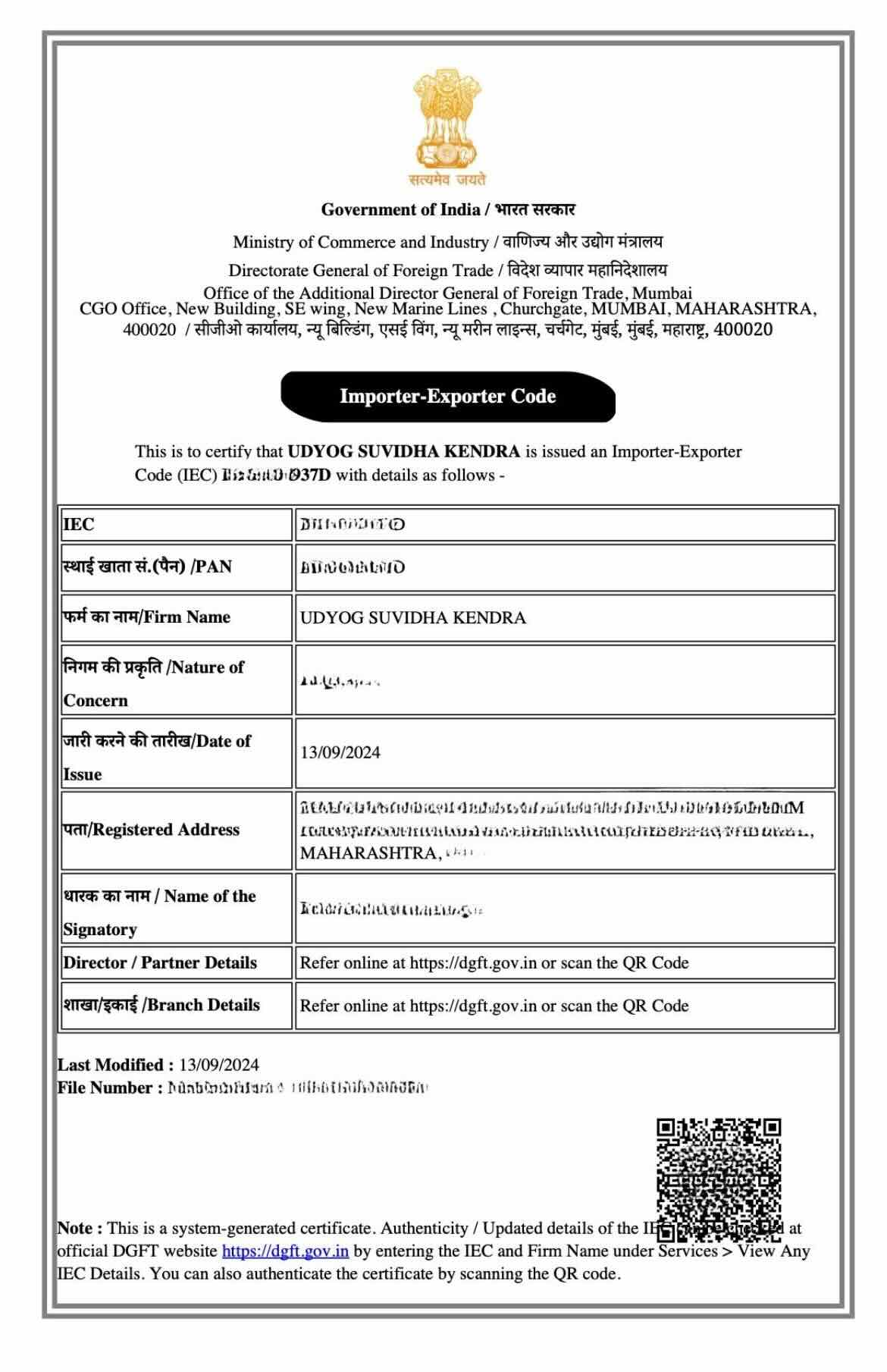

Import Export Registration

Import Export Registration

4.8 4355 customers

Process of

Import Export Registration

STEP 1

- Fill Online Application Form & Make Payment

- Get Call for Further Information, Documents & Advice

STEP 2

- Review and Verification of Documents Received

- Creation of Login Credentials for the Company

STEP 3

- Dedicated IEC Associate will Apply for IEC

- Government Processing Time

STEP 4

- Resolution of Queries if any, Raised via Authorities

- Issuance of Import Export Certificate on email