We are India's fastest growing online business services platform dedicated to helping people to start and grow their business, at an affordable cost. Our aim is to help the entrepreneur with regulatory requirements, and offering support at every stage to ensure the business remains compliant and continually growing. We are Private Organization and providing services and assistance for Business Benefits who require consultation on IEC.

Application For

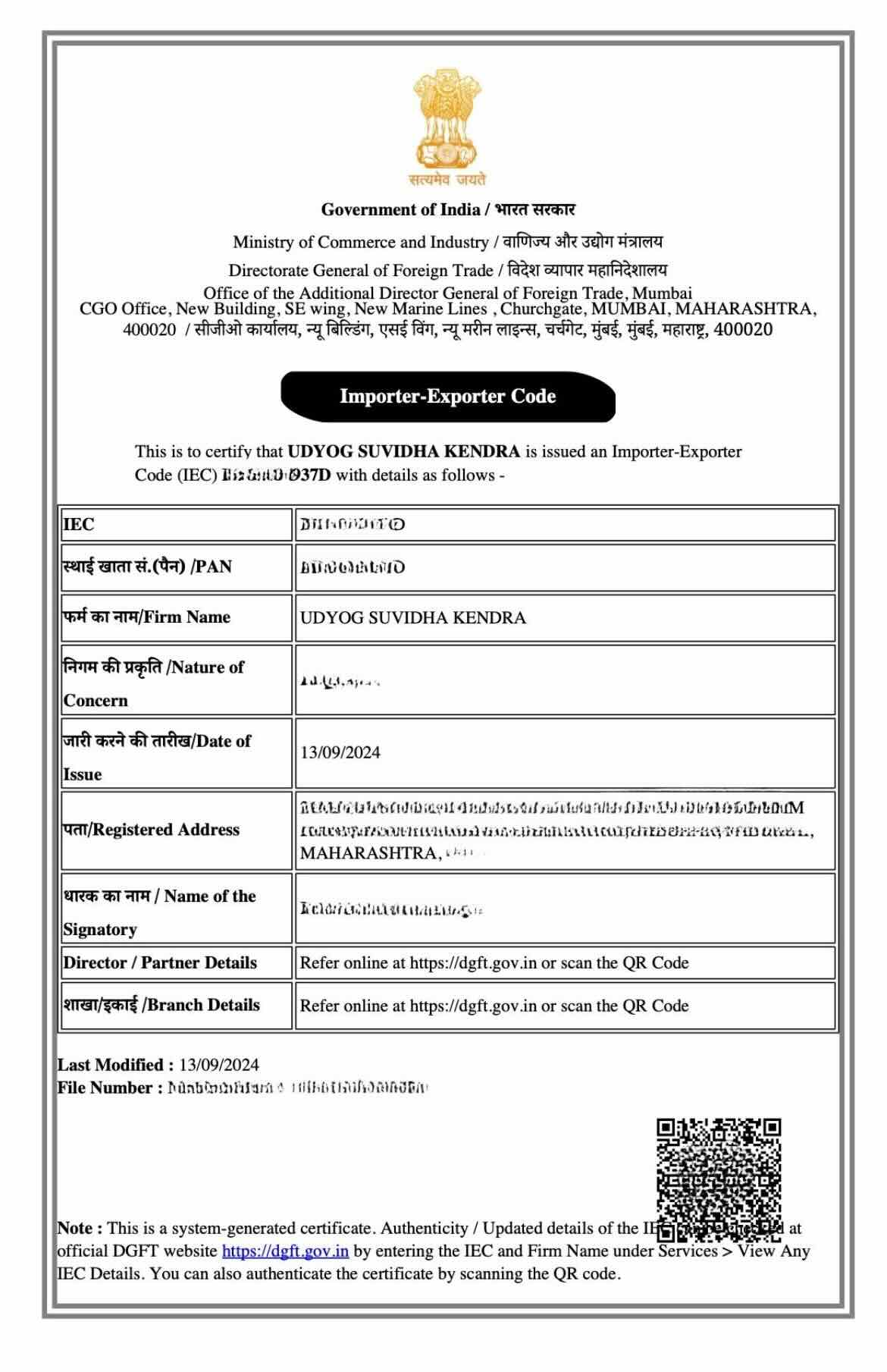

Import Export Registration in Shiliguri

Import Export Registration in Shiliguri

4.8 4355 customers

Process of

Import Export Registration in Shiliguri

DAY 1- 2

- Fill Online Application Form & Make Payment

- Get Call for Further Information, Documents & Advice

DAY 2 - 4

- Review and Verification of Documents Received

- Creation of Login Credentials for the Company

DAY 5 - 7

- Dedicated IEC Officer will Apply for IEC

- Profile Completion on National Single Window

DAY 8 - 9

- Filing of an Application using the Credentials

- Government Processing Time

DAY 10 - 15

- Resolution of Queries if any, Raised via Authorities

- Disptach of Company DSC with Token

- Issuance of Startup Certificate on email