Online Application Form For

Gumasta Registration in Alibag

Gumasta Registration in Alibag

4.8 4355 customers

About Gumasta Registration

What is a Gumasta License?

Gumasta license is a type of registration required to do any kind of business in the state of Maharashtra. To start any type of business in Maharashtra, entrepreneurs require Gumasta License. This license is governed by Municipal Corporation of Mumbai and/or Labour Department under the Maharashtra Shops and Establishment Act, 2017. Gumasta License provides the authority to entrepreneurs to start their businesses at a particular place, area or location that exists anywhere in Maharashtra, India.

Who needs to obtain a Gumasta License?

Gumasta License is required to be obtained by business owners, entrepreneurs, self-employed professionals, public and private limited companies, sole proprietorship, partnerships and LLPs that want to open physical shops, hotels or commercial places in Maharashtra.

Gumasta License is necessary for all businesses employing less than 9 employees (Intimation Certificate will be issued) OR business having 10 or more workers(Gumasta Certificate verified by authority) in a shop or establishment. This certificate or license helps in the regulation of the benefits of employees in the condition or situation they work and aspects regarding payment and rules of their employment. This license or certificate is the basic or mandatory requirement to get recognized by all the banks and NBFCs working for people in Maharashtra.

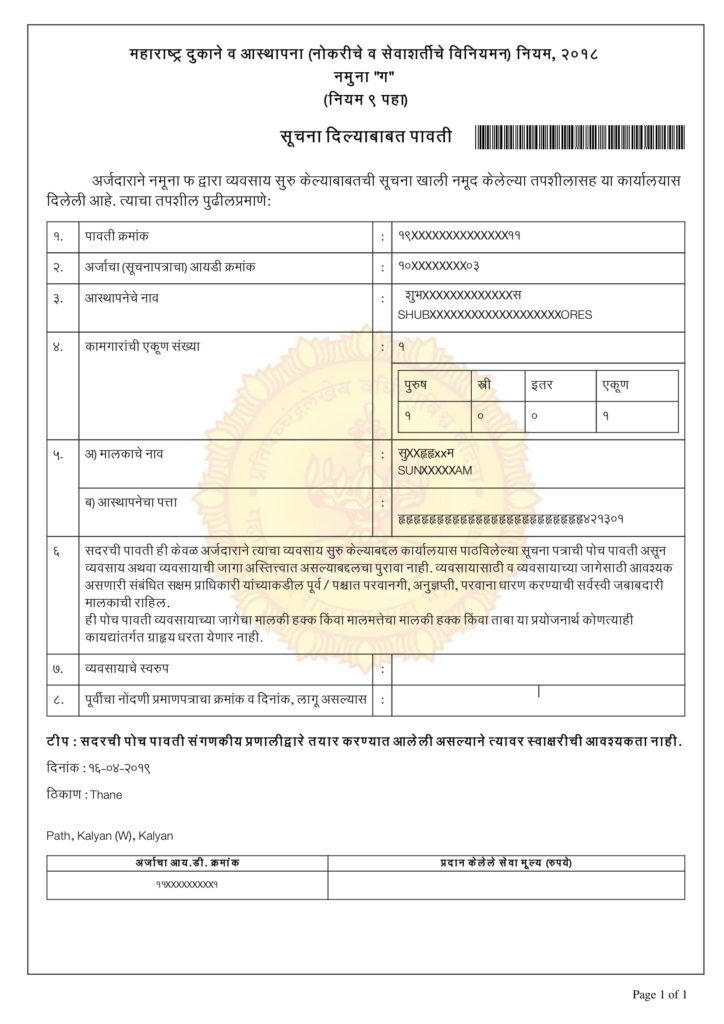

Components of Gumasta License or Registration

Name and year of establishmentNature of business

Name of the employer

Other related details and information